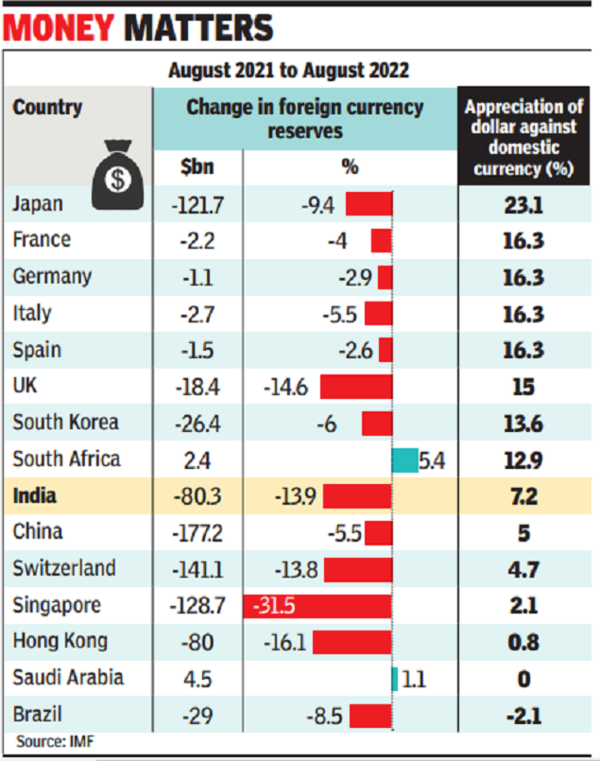

Some countries have depleted their reserves to a greater extent, but have also managed to achieve greater stability for their currency relative to the Indian rupee.

In the global free fall of currencies against the US dollar, central banks around the world are selling dollars from their forex reserve to increase their supply in the forex markets and thereby reduce the price against their own currencies.

Among these 15 major economies – the largest in the world and those with the highest currency reserves – eight saw the dollar appreciate against their national currency greater than the Indian rupee. Japan leads this list with a 23.1% appreciation of the dollar against its currency between August 2021 and August 2022. Its central bank spent $ 121.7 billion (9.4%) of its reserve, but this intervention seems to have failed to stop the yen’s fall.

Similarly, the British pound, another currency that has seen the US dollar appreciate more than the Indian rupee, has failed to find stability despite the 14.6% depletion of the country’s forex reserves. All the other countries – France, Germany, Italy, Spain, South Korea and South Africa – have not used their forex reserve either in absolute terms or percentages to the extent that India has done to stabilize its currency. The Indian rupee remained stronger than all of these currencies, but came at a cost of $ 80.3 billion (13.9%) of the forex reserves it had in August 2021.

During this same period, China used $ 177.2 billion (5.5%) of its forex reserve and witnessed a 5.5% appreciation of the US dollar against the yuan. Likewise, Switzerland and Singapore also depleted their foreign exchange reserves by more than $ 100 billion, but kept their currencies relatively stable: the dollar appreciated 4.7% against the Swiss franc and 2.1%. % against the Singapore dollar. Hong Kong used $ 80 billion of its forex reserve, almost like India, but managed to stabilize its currency to a much greater extent. The US dollar appreciated 0.8% against the Hong Kong dollar. Brazil depreciated its reserve by $ 29 billion, but saw the dollar depreciate by 2.1% against its real, the only currency on this list to have strengthened against the dollar over this period.