MUMBAI:

The RBI’s state of the economy report said the fight against inflation will be “stubborn and protracted” given the long and variable delays in monetary policy. He added that if the RBI manages to reduce inflation, will strengthen India’s prospects as one of the fastest growing economies in the world.

The state of the economy report, which is in the nature of an article written by RBI staff, including Deputy Governor Michael Patra, said headline inflation is set to decline from its September high. The decline will be due to slowing momentum and favorable base effects.

The central bank’s comments on inflation come after it released the minutes of the September 28-30 monetary policy committee meeting on Friday. The minutes revealed that committee members were divided on the future course of the tariff action. Retail inflation had risen to a high of 7.41% in September.

The RBI said easing inflation could be driven by food and drink, which suffered repeated shocks in the first half of the year. The report notes the global slowdown triggered by “aggressive and synchronized monetary tightening,” which has weakened the global economic outlook as financial markets have been sold, investors have become scared and have abandoned risky assets.

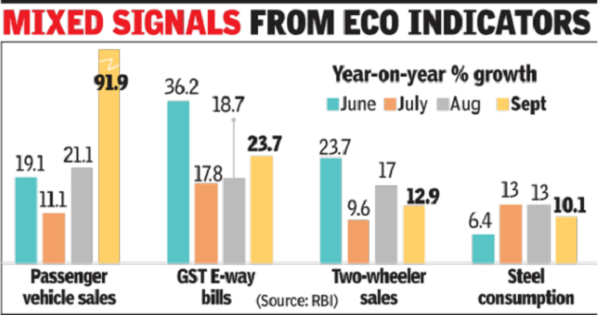

“In India, economic activity in general has remained resilient and is poised to expand further as domestic demand accelerates while contact-intensive sectors are experiencing a rebound. Robust credit growth and strengthened bank and corporate balance sheets. they provide additional strength to the economy. ”

“Although the persistence of CPI (consumer price index) main inflation above the tolerance band for three consecutive quarters (until September) will trigger mandatory accountability processes, monetary policy remains focused on realigning inflation with the ‘objective “, reads the article.

The RBI has indicated that it will write to the government soon about the failure to meet the inflation target. The communication will take place after a meeting of the MPC. In the letter, the central bank is also expected to announce its plans to fall within the target range of 2-4%.