In an affidavit to be heard by a five-judge panel seized of a series of petitions contesting 2016 demonetization decision, the government said, “There has been a massive increase in the circulation of Rs 500 and Rs 1,000 notes compared to Rs 50 and Rs 100 in the previous five years, as per RBI data.”

“This showed a sharp increase in the top two denominations i.e. 76.4% for Rs 500 and 109% for Rs 1,000 from 2010-11 to 2015-16. The added feature was also that the Center and RBI had taken consider introducing a new series of banknotes which can tackle black money, counterfeiting and illegal financing while withdrawing the legal tender denomination of Rs 500 and Rs 1,000,” he said.

The government said India had a workforce of 481 million as per the 2011 census, of which around 400 million were in the unorganized sector. Informal employment in India also makes up a much higher share of non-farm employment than in most other economies, he said. Demonetization was one of the steps in expanding the formal sector and contracting the informal sector, he said.

Policy push included digitization of transactions: government over demonetization

In its Supreme Court affidavit on its 2016 demonetization decision, the Center said: “The withdrawal of these legal tender currencies was one of the significant steps in the greater formalization of the economy with the aim of expanding opportunities for millions who live on the periphery of the economy.”

“The policy push included digitizing transactions, technology connectivity and implementation to enable last mile reach, increase the tax base, improve tax compliance, reduce costs of doing business, eliminate policy distortions, ease the ‘financial inclusion at the formal sector level and labor and land reforms,’ it reads.

The Center said the number of counterfeit banknotes and their value have dropped significantly due to demonetisation and the volume of digital payments has increased from 1lakh transactions worth Rs 6,592 crore in 2016 to over 730 crore transactions in the worth over Rs 12 lakh crore in a single month of October 2022.

“To sum up, the withdrawal of the Rs 500 and Rs 1000 notes was in itself an effective measure and was also part of a wider strategy to combat the threat of black money, counterfeit money, terrorist financing and tax evasion, but not limited only to any of them. It was an economic policy decision exercised in accordance with the powers conferred by the RBI Act of 1934,” he said.

Calling the decision well considered, the Center said it was taken after extensive consultations with the RBI and with advance preparations. “Preparations included finalizing new designs, developing security inks and printing plates for the new designs, changing press specifications, and replenishing stock with RBI branches in various parts of the country,” he said .

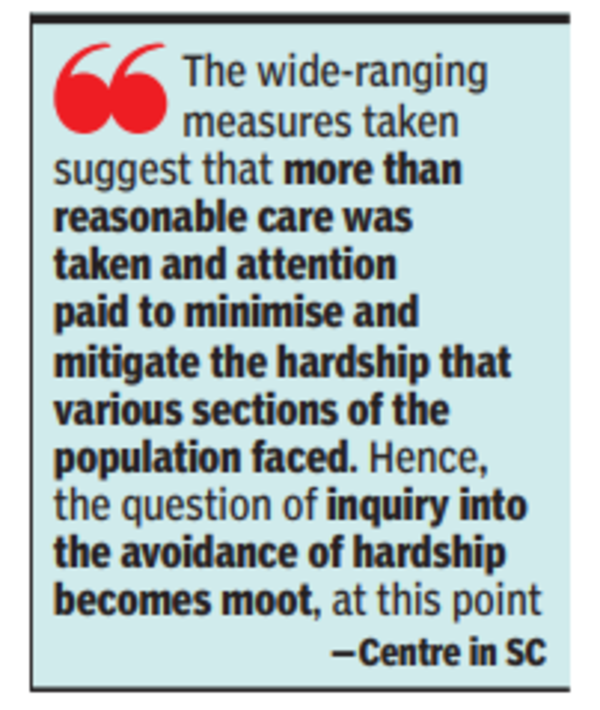

Dissuading SC from investigating the measures taken to mitigate citizens’ short-term hardships in 2016, the Center listed the measures taken in 2016 to alleviate people’s hardships.