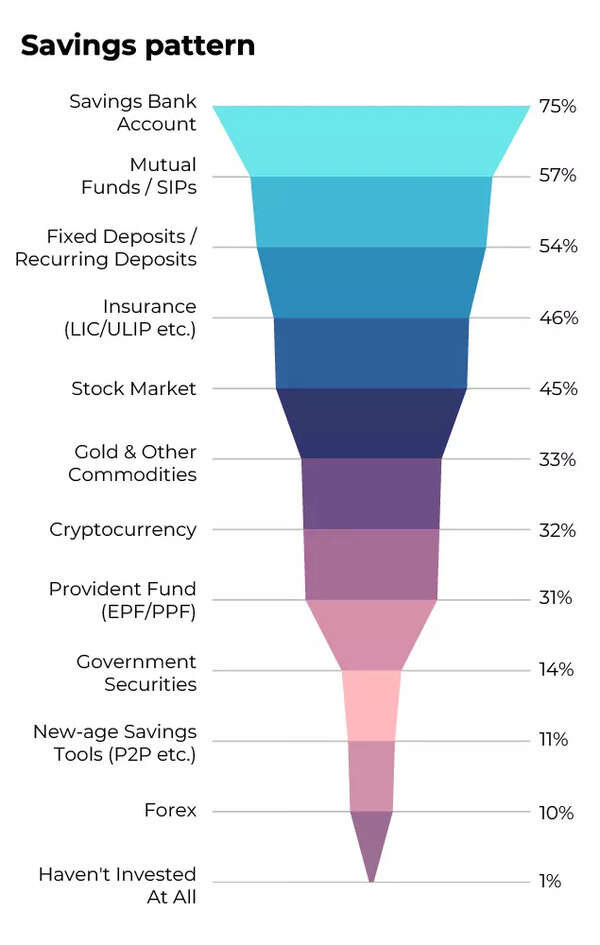

However, fixed deposits continue to be most preferred by the 35-45 age group among wage earners, compared to 54% in the 28-34 age group and 47% among 22-27 year olds.

Investments in mutual funds were highest in the East (67%), followed by the North (65%) and West (62%).

Investments in low-yield products such as endowment plans also remained high, with nearly 46% of respondents investing in them. Interestingly, 50% of men had invested in traditional insurance plans compared to 41% of women.

Surprisingly, cryptocurrency has also surpassed public pension funds as an investment choice.

At least 32% of respondents revealed that they have invested in cryptocurrencies, while only 31% have invested through the retirement fund route.

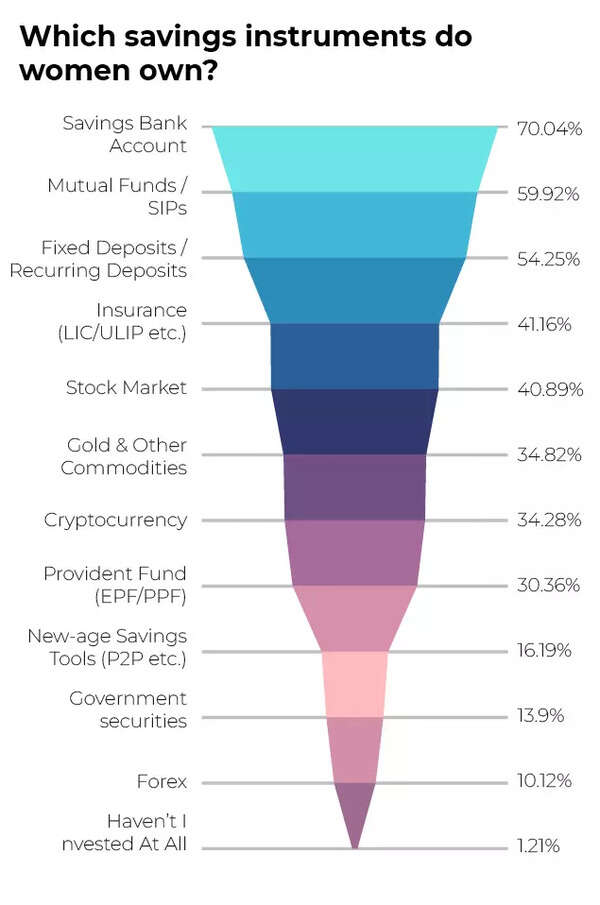

Women taking the lead

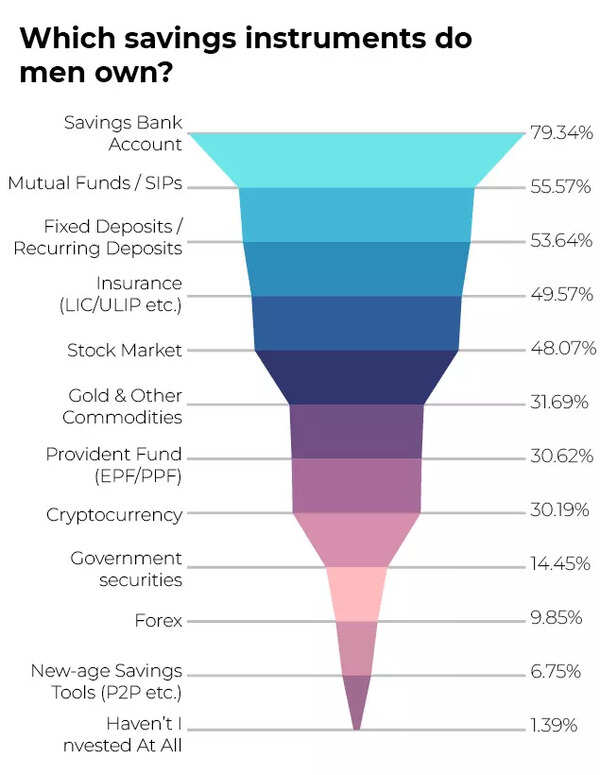

The survey revealed that women are saving more actively than is usually perceived. More women hold mutual fund investments than men: Nearly 60% of women have SIPs running versus 55% of men.

About 54% of women have FD compared to 53% of men.

The percentage of men, however, who invest directly in stocks is much higher than women.

About 34% of women have investments in cryptocurrencies compared to 30% of men.

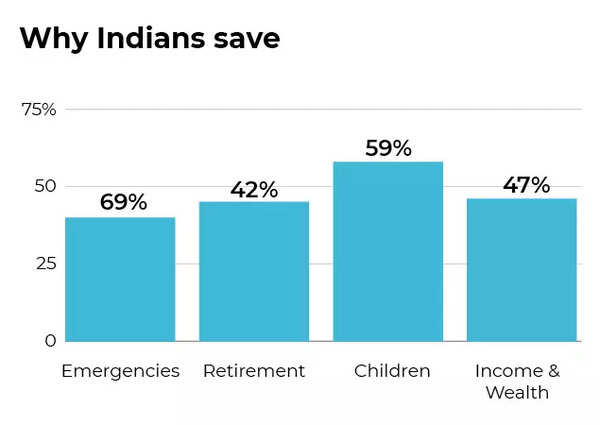

Rainy Day Concerns: Why Are Indians Saving Up?

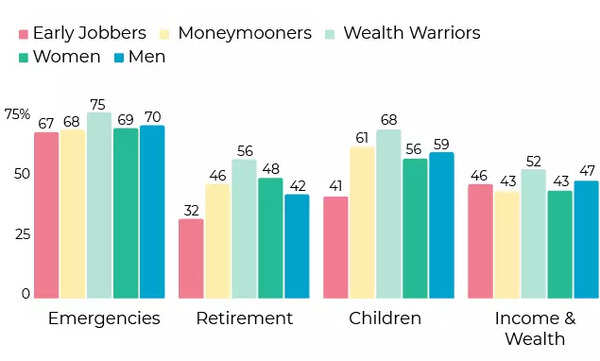

Post Covid, concern about emergencies like hospitalizations has been the main reason to save money across the board. This was followed closely by the children’s welfare and inheritance. Retirement, curiously, came in a distant fourth.

Women are more aggressive when it comes to saving for retirement, with 60% of women planning for retirement compared to 52% of men.

More than 60% of respondents said they have a pension corpus. This is heavily biased in favor of women, with 68% of women working for a corpus compared to 54% of men.

Overall, only 44% of them are working towards a corpus of Rs 1 crore or more, and less than 16% are targeting Rs 2 crore or more. The majority of respondents (56%) have a target corpus below Rs 1 crore, with 35% in the Rs 25-75 lakh range.

About 48% of women have a target corpus of Rs 1 crore or more compared to 40% of men. However, only 15% of women have an average target body size of Rs 2 crore or more compared to 18% of men.

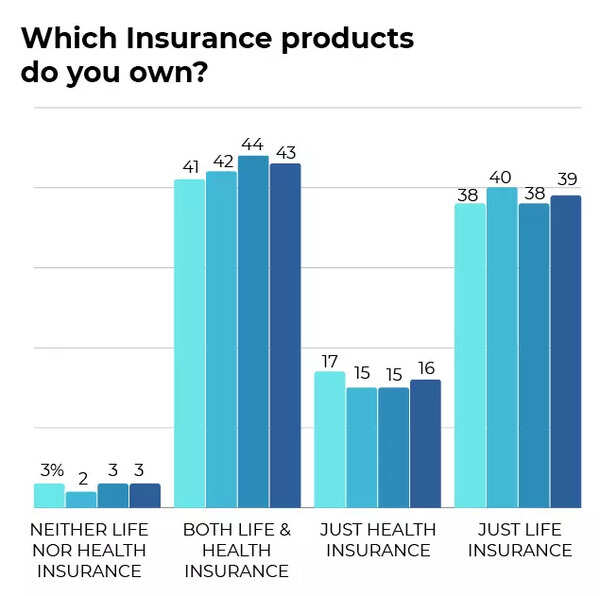

The survey also showed that insurance penetration is very high among the working class. Only 3% have no health or life insurance.

About 43% of respondents have both health and life insurance, and 39% have life insurance without health coverage.