Remittances to India are money transfers from non-resident Indians (NRIs) employed outside the country to family, friends or relatives residing in India. Remittances account for almost 3% of India’s gross domestic product (GDP).

Historically, the Gulf Cooperation Council countries have been the main destination for migrants from South Asia, but a gradual structural shift in favor of high-income countries for Indian migrants is taking place. In recent years, many Indians have moved into highly skilled, well-paid jobs in high-income countries, such as the US, UK and Singapore.

Notably, India received $89.4 billion in remittances in 2021, according to the World Bank report, which then made India the top recipient globally.

“2022 will be a memorable year for India as its remittance flows soar to $100 billion from $89.4 billion in 2021, growing 12% from 7.5% in 2021,” the report said.

This means that India is set to retain the largest number of remittance recipients in 2022 as well, much sooner MexicoChina and the Philippines.

What has stimulated this flow of remittances to India?

Gradual shift of the main destinations of Indian migrants

First, remittances have benefited from a gradual structural shift in the main destinations of Indian migrants, moving from largely low-skilled informal employment in Gulf Cooperation Council (GCC) countries to a dominant share of jobs highly skilled in high-income countries such as the US, UK and East Asia (Singapore, Japan, Australia, New Zealand).

Between 2016-17 and 2020-21, the share of remittances from the US, UK and Singapore increased from 26% to over 36%, while the share from the 5 GCC countries (Saudi Arabia, UAE, Kuwait, Oman and Qatar) fell from 54% to 28%.

With a 23% share of total remittances, the US overtook the UAE as the top source country in 2020-21.

About 20 percent of Indian emigrants are in the United States and the United Kingdom.

According to the US Census, of the approximately 5 million Indians in the US in 2019, approximately 57% had lived in the nation for more than 10 years. During this time, many earned bachelor’s degrees that prepared them to quickly move into the higher income category.

The Indian diaspora in the US is highly skilled:

In 2019, 43% of US residents born in India had a college degree, compared to only 13% of US residents. Only 15% of Indian-born residents aged 25 and older had no more than a high school diploma, compared to 39% of US-born residents in that age group. Meanwhile, 82% of all Indians in the United States (compared to 72% of all Asians) and 77% of foreign-born Indians knew English well.

Higher education is associated with high income levels with direct implications for remittance flows. In 2019, the median household income for Indians in the United States was nearly $120,000 compared to about $70,000 for all Americans. Structural change in skills and destinations has accelerated the growth of remittances linked to high-wage jobs, especially in services, the report said.

During the pandemic, Indian migrants in high-income countries have been working from home and benefiting from large tax incentive packages. Post-pandemic, wage increases and record working conditions have supported remittance growth despite high inflation.

Secondly, the economic conditions in the GCC (30% share of India’s remittances) have also worked in India’s favor.

Most of India’s GCC migrants are factory workers who returned home during the pandemic Vaccinations and the resumption of travel helped more migrants return to work in 2022 than in 2021.

The GCC’s price support policies have kept inflation low in 2022 and rising oil prices have increased demand for labour, allowing Indian migrants to increase remittances and counter the impact of record inflation India on real incomes of

their families.

Taking advantage of the depreciation of the rupee

Third, Indian migrants may have taken advantage of the depreciation of the Indian rupee against the US dollar (10% between January and September 2022) and the increase in remittance flows.

Remittances to India are also expected to rise 4% next year, supported by the large share of Indian migrants earning relatively high wages in the US, UK and East Asia (whose remittances may be more resilient than those of migrants with lower wages, for example in the GCC).

“2023 will be a test case for the resilience of South Asian white-collar migrant remittances in high-income countries. Higher inflation in the US accompanied by an economic slowdown will ease remittance flows to India, with growth falling to 4%.The drop in oil prices from $98 to $85 per barrel (2002-2003), combined with the decline in economic growth in the GCC, will strengthen downward pressure on remittance flows to all South Asian countries,” the report said.

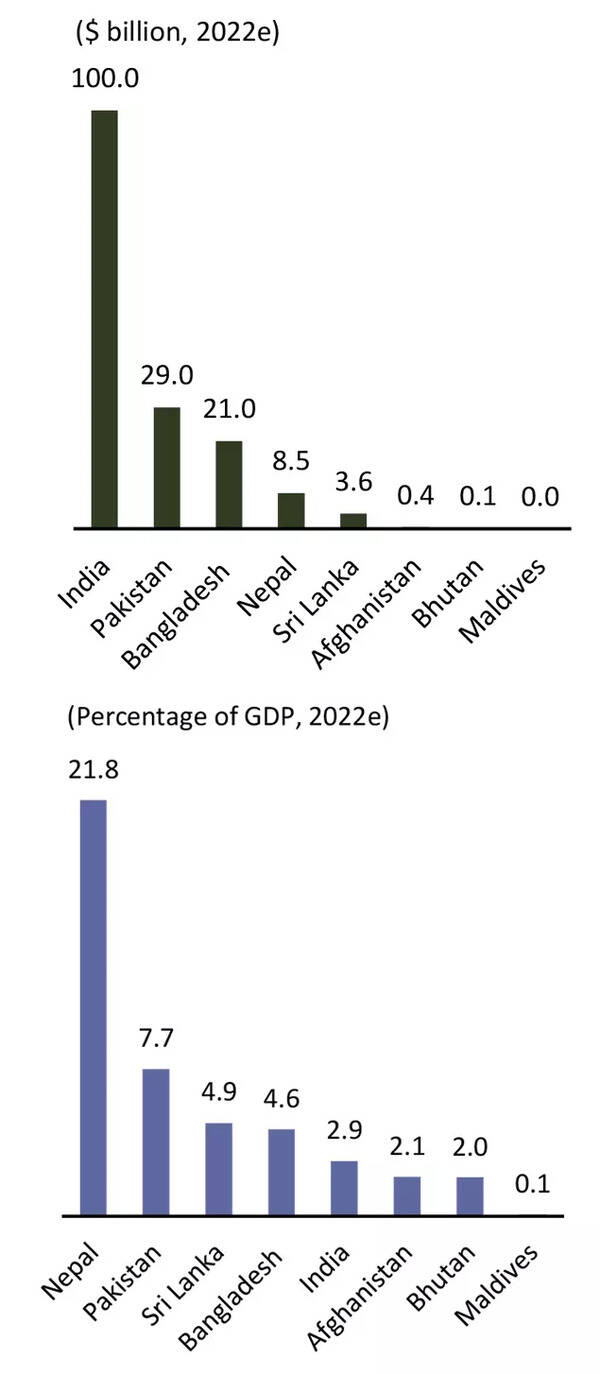

Top recipients of remittances in South Asia, 2022e

Other highlights from the report:

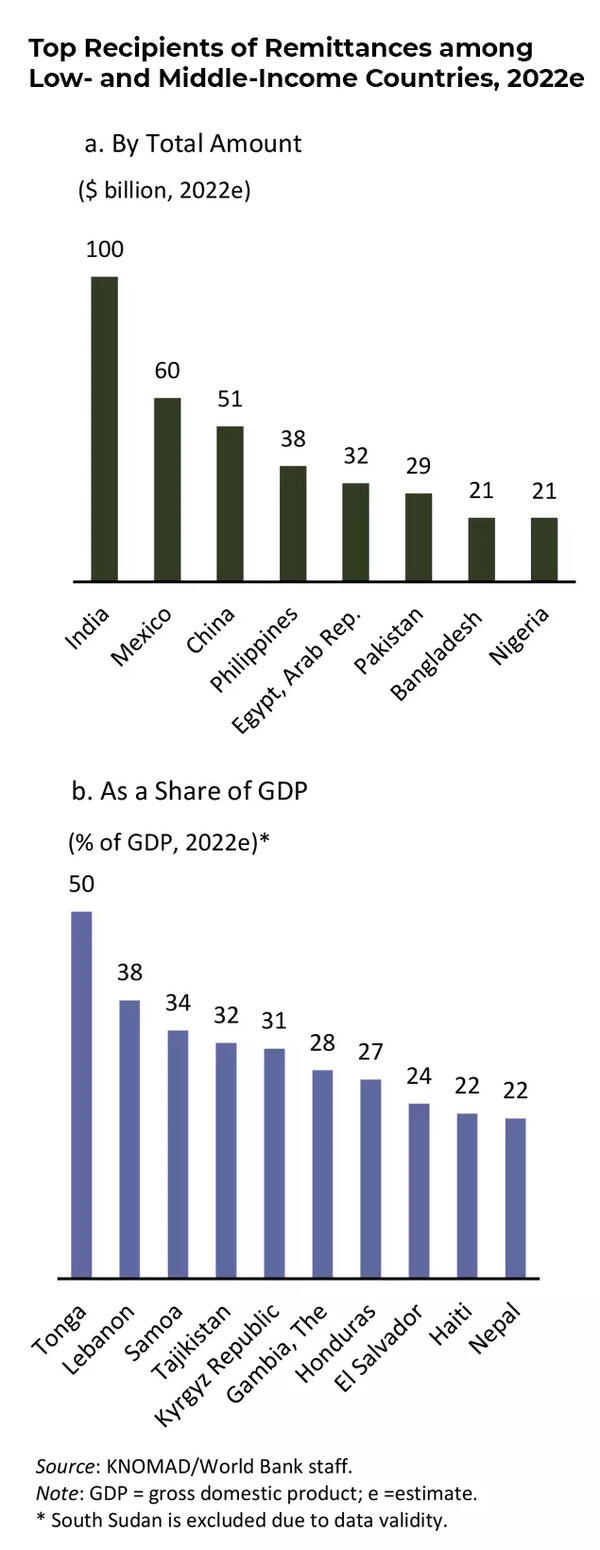

The top five remittance recipient countries in 2022 are expected to be India, setting a benchmark of $100 billion in the year, followed by Mexico with a tally of $60 billion (which displaced China in second position in 2021), and China, the Philippines, and the Arab Republic of Egypt.

Among the economies where remittance inflows account for very large shares of GDP, highlighting the importance of remittances in financing current account and tax shortfalls, the Pacific Islands Tonga (50% of GDP) and Samoa (34%) stand out place in the top ten, given their exposure to the vagaries of tourism and vulnerability to disasters.

Remittance flows to South Asia are projected to increase by 3.5% to reach $163 billion in 2022, a notable slowdown from the 6.7% increase in 2021, but benefiting from a strong performance in India and Nepal.

Remittance flows to India were boosted by wage increases and strong labor markets in the US and other OECD countries. In GCC destination countries, governments ensured low inflation through direct support measures that protected migrants’ ability to remit.

Overall growth in remittances in South Asia (3.5% in 2022) masks a large disparity between countries’ results, from India’s 12% increase, Nepal’s 4% increase, to an aggregate decline by 10% for the remaining South Asian countries