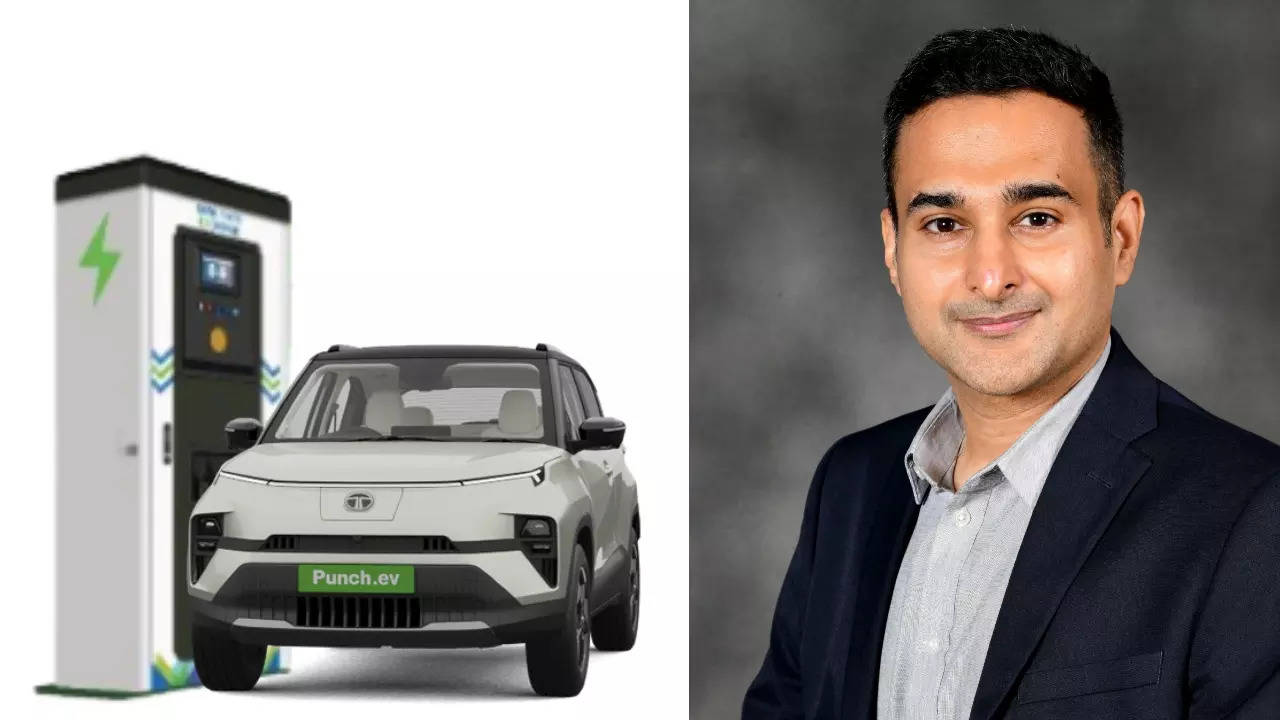

The response to Tata Motors’ latest EV model, the Punch EV, has been overwhelmingly positive, according to Balaje Rajan. “In terms of bookings and consumer feedback, the Punch EV has been well-received. Customer reviews indicate that this is a product meant for India; particularly considering the range and price. It serves as a multipurpose SUV, fitting a wide profile of customers.” he said.

Recently, the company has reached a milestone, selling over 1.5 lakh EVs in India. TPEM saw a 48 percent Y-o-Y growth, selling 73,800 EVs in FY2024 compared to 50,000 in FY2023. By the end of the ongoing FY, two new models, the Curvv EV and Harrier EV, will join the company’s EV stable.

Tata Punch EV Review Brilliant but needs these small improvements | TOI Auto

While the Punch EV’s bigger and older sibling, Nexon EV, continues to dominate the electric PV segment for the brand, the ICE Punch has proven to be a top performer, consistently ranking among the top two best-selling cars in India since the beginning of the year. “The ICE Punch was the number one vehicle in the last quarter, and we expect the Punch EV to attract a similarly broad customer base. Despite some headwinds in the auto industry this month and in April and May, we saw a strong response in the last quarter and anticipate continued growth in the coming months.” he added.

Although electric vehicle sales have been rising steadily, especially post-COVID, customers across India still show some hesitation in opting for BEVs. When asked about the biggest challenges reported by customers, Rajan highlighted concerns around charging availability and awareness. “Charging availability and awareness are the biggest issues. There is already a significant charging infrastructure with over 10,000 chargers pan India, but people’s awareness of this is really low,” he noted.

He also said that Tata Motors is solving this problem with a new app that shows all available chargers and their current status. The Beta version of the app is already made and should be available in the next few months. In the first phase, the application will support features such as ‘find and locate’ after which the company will gradually integrate the payment feature as well.

“For those who have bought EVs, they enjoy the quiet ride and single-pedal driving, particularly in stop-and-go city traffic. However, initial charging anxiety remains, which we hope to alleviate with our aggregator app.”

The company has also established a partnership with its sister subsidiary, Tata Power, one of the leaders in the charging market in India. At present, the company also practices open collaboration, sharing insights with charging providers based on customer data to help plan their networks better. This approach has led to partnerships with BPCL, HPCL, Shell, ChargeZone, Zeon, Glida (Fortum), and Static. These collaborations aim to improve charger utilization and drive greater EV adoption.

At present, most EV owners do their charging at home and there are limitations of home charging. When asked about how Tata is addressing the issue, Rajan explained “The primary growth lever is community charging, particularly in apartments where individual parking spots are unavailable. In such cases, customers don’t need a dedicated charging spot in their personal parking space but can simply go to the basement and find five or more charging points at their disposal,”

“We’ve seen success with community chargers in metro cities, driving greater EV adoption. We expect similar models to expand to other areas, providing charging solutions to those without private parking.”

Further, speaking on the company’s plans to evolve from 30-50 kW chargers as the battery sizes in EVs increase, he said “As battery capacities increase, we will see more higher-capacity chargers. However, there are grid limitations to consider for much higher capacity chargers. The current infrastructure supports 30 and 50 kilowatt chargers, suitable for the majority of vehicles today. Higher capacity chargers will be introduced as the need arises, and the grid evolves.”

Currently, there are around 10,000 publicly accessible chargers in India. Oil marketing companies plan to add over 17,000 more chargers this year. Overall, the number of chargers are expected to grow from 10,000 to 30,000 within the next two years.

“One key point is the misconception about charging infrastructure. There are nearly twice as many publicly accessible EV charging points as CNG stations. This information can help alleviate concerns about charging availability.” he noted.