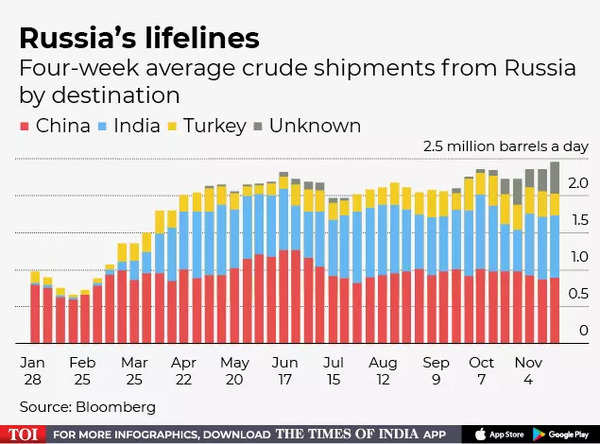

The country is Asia’s second-largest importer of crude oil and actively purchases a range of grades from Ural flagship to oil shipped from the Far East: ESPO and Sokol.

With Group of Seven (G7) nations proposing a price cap of $65-$70 a barrel for Russian oil, it will be beneficial to countries like India, China and other major buyers who have been scrapping discounted barrels since the U.S. and its allies have imposed sanctions on Russia.

The existence of a ceiling would give them the possibility to lower the price they pay to Russia.

The Russia-Ukraine war has had a far-reaching impact on the global energy system, disrupting supply and demand patterns and severing longstanding trade relationships.

It has pushed up energy prices for many consumers and businesses around the world, hurting households, industries and entire economies of several nations.

Because a price limit is introduced

The G7, including the United States, as well as the entire European Union and Australia, are planning to implement price caps on maritime exports of Russian oil on December 5th.

The limit is intended to cut Russia’s oil revenues by keeping Russian crude on the market by denying insurance, marine services and financing provided by Western allies for tanker cargos priced above a fixed limit of one dollar per barrel.

A historical average of Russian Ural crude of $63-64 a barrel could be an upper limit.

The cap is a concept promoted by the US since the EU first unveiled plans in May for a Russian oil embargo to punish Moscow for its invasion of Ukraine.

Insurance companies and other businesses needed to ship oil would only be able to deal with Russian crude if the price of oil is at or below the cap. Most insurers are based in the EU or UK and may be required to participate in the cap. Without insurance, tanker owners may be reluctant to take on Russian oil and face obstacles in its delivery.

What will be the maximum price

G7 and European Union diplomats have discussed a maximum price for Russian oil of between $65 and $70 a barrel, but no deal has yet been reached.

Russian President Vladimir Putin has said Moscow will not supply oil and gas to any country that joins the imposition of the cap, such as the Kremlin.

The price cap is expected to take effect on December 5, the same day an EU ban on Russian crude kicks in, and ahead of the next meeting of the Organization of the Petroleum Exporting Countries and Allies, known as OPEC+, on December 4. December.

However, EU governments remained divided over how much to cap Russian oil prices to curb Moscow’s ability to pay for its war in Ukraine without causing a global oil supply shock.

A higher price cap could make it attractive for Russia to continue selling its oil, reducing the risk of a supply shortage in global oil markets.

Poland wants the cap set at $30, arguing that with Russian production costs some estimate at $20 a barrel, the G7 proposal would allow Moscow to make too many profits.

India’s purchase of Russian crude oil

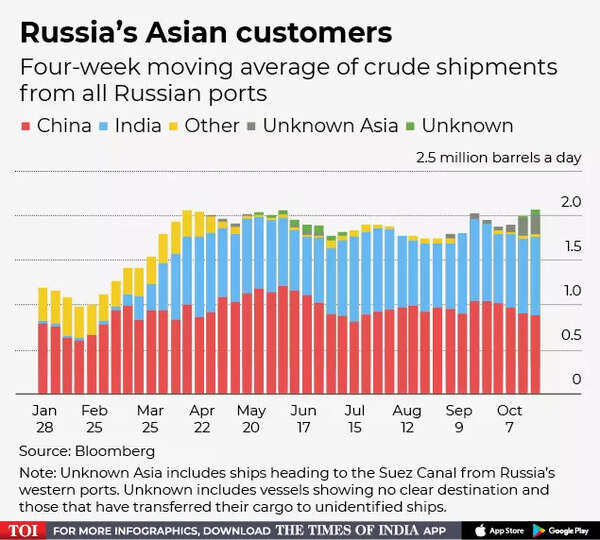

Oil refineries in India have bought almost all grades of Russian crude, taking advantage of the discounts. Indeed, India has pushed itself into a corner of the Russian oil market once dominated by China.

Six vessels carrying Russian crude known as ESPO were headed for refineries in the South Asian nation in August, according to ship traders and brokers. This is the highest number of cargoes purchased from India since the flow was introduced and accounts for nearly a fifth of available monthly shipments.

As the conflict dragged on, the third-largest oil importer first ramped up purchases of top Ural crude, which is loaded from western Russia, and is now competing for ESPO, a distillate-rich grade that originates from the east and was typically favored by Chinese buyers.

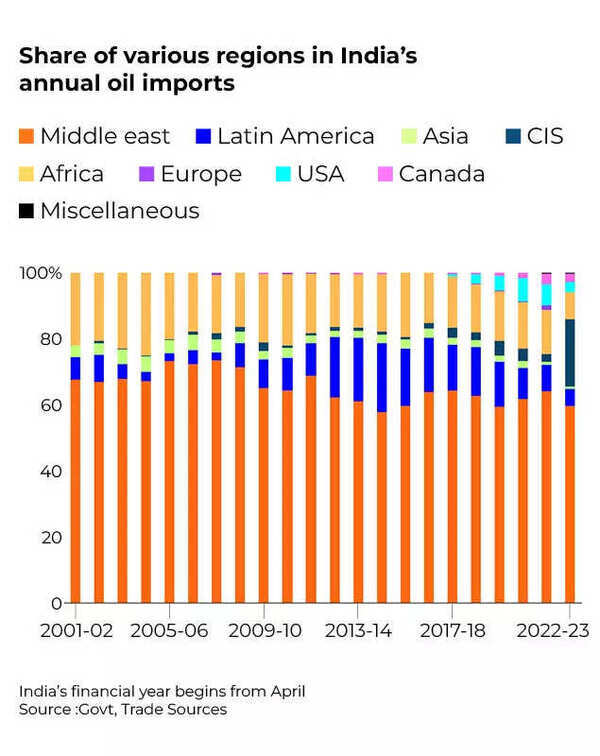

Russia’s share of oil imports from India rose to an all-time high of 23% from 19% the previous month, while that of the Middle East fell to 56.4% from 59%, according to the data.

Iraq remained India’s top supplier, while Russia overtook Saudi Arabia as the second largest after a month-long hiatus.

How will the price cap impact India

According to a Reuters report, some refiners in India are paying the equivalent of a rebate of about $25 to $35 a barrel for the international benchmark Brent crude for Russia’s Urals crude.

With Brent trading at around $86 a barrel on Friday, that would imply a $50-$60 a barrel Urals price, which is below the cap.

Indian refineries typically pay for the delivery of crude oil, including insurance and freight.

Even for delivered Urals crude, India is paying $15-$20 a barrel below Brent, a source said. This means that the delivered loads are also about the same level as the maximum price.

Hence, Indian refineries are already receiving Russian oil at or near below price levels. So how and when the price caps are imposed are unlikely to have a negative impact on oil imports from India.

Urals is negotiating with other buyers at a similar $30-$35 discount on dated Brent, trade sources said. Oil produced by the Rosneft-sanctioned state oil company is on the lower end and not Rosneft slightly higher.

India wary?

Indian refiners are wary of buying Russian crude past the December 5 date of the EU import ban and the proposed price cap, according to a Reuters report.

Major refineries Reliance Industries and state-controlled Bharat Petroleum are pulling back from placing orders, according to two sources familiar with the purchase plans.

Lower December volumes follow India’s heavy imports of Russian crude in recent months. Refinitiv estimates November arrivals at 1.0 million bpd, which would make Russia the month’s top supplier, ahead of Iraq’s 960,000 bpd.

“Consider India an opportunity”

India hopes to convert the current global oil challenges of the Ukraine crisis into an opportunity to secure affordable energy, Oil Minister Hardeep Singh Puri said, a day after the European Union failed to agree on a cap maximum for the price of Russian oil.

“Right now, the concern is not where we’re going to get energy from,” Puri said. “It’s a global challenge, but we have and will turn it into an opportunity. And I don’t foresee any difficulties in sourcing and securing affordable energy.”

The West has exempted supplies of Russian oil via pipelines to Hungary and China, and exports from Sakhalin-2 projects to Japan. “So the question arises who will impose this cap, if there are these three big exemptions,” Puri said, indicating that the mechanism is aimed at supplies to India.

Puri, however, said he was not concerned about the disruption of oil supplies after Dec. 5, adding that India has rapidly diversified its sources of crude oil and could buy more oil from the United States, Guyana and other nations in the coming years.

Diversified sources

While India has benefited hugely from Russian oil imports, profits have shrunk in recent months due to Moscow’s capping of discounts, tightening of sanctions and an increase in forward supplies by the refineries.

India is now turning to Africa and the Middle East instead of Russia due to higher freight rates.

To secure supplies, Indian Oil Corporation (IOC) in September signed its first six-month oil import agreements with Brazil’s Petrobras for 12 million barrels and Colombia’s Ecopetrol for 6 million barrels.

Bharat Petroleum Corporation (BPCL) has signed an initial deal with Petrobras in a bid to diversify oil sources.

The IOC is also seeking more short-term supplies, including a contract for US oil, according to sources cited by Reuters. The IOC already has an annual agreement that includes an option to purchase 18 million barrels of US oil. Of that, the IOC has already bought about 12 million barrels so far this year, they said.

The sources also said that BPCL, which has already ramped up oil purchases in the US, is looking for more futures contracts.

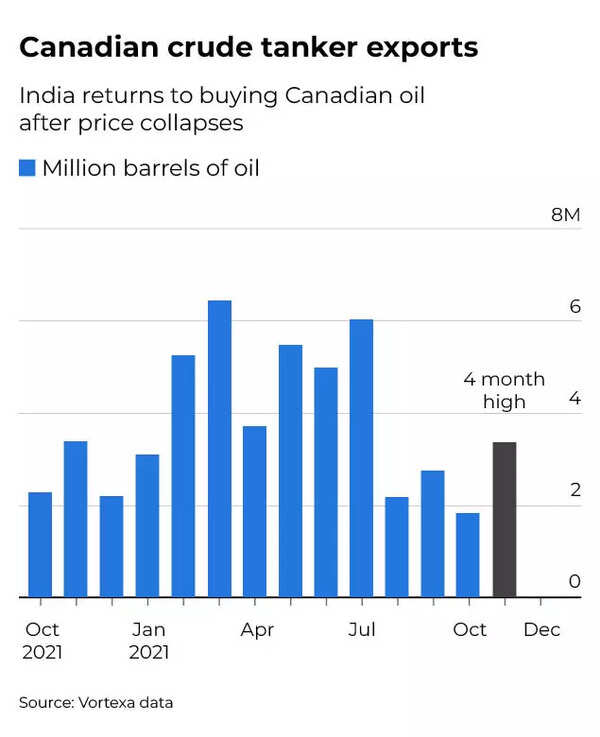

Also, with the discount of Canadian heavy crude to West Texas Intermediate crude on the Gulf Coast hitting a record high, Indian refiners have opportunistically ramped up purchases.

A total of 3.3 million barrels of Access Western Blend, a crude produced in the Alberta oil sands, is expected to arrive in India next month after leaving the US Gulf, according to Vortexa Ltd.

(With contributions from agencies)