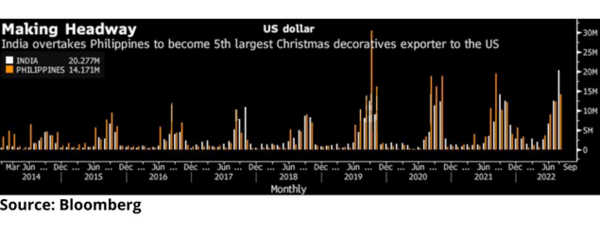

According to US customs data, sea shipments of festival items and accessories to America hit $ 20 million last month, nearly three times the value from a year ago. In the process, India has gained a clear advantage over the Philippines as buyers diversify their sources of supply in the face of rising labor costs and disruptions to China’s strict Covid-zero policy.

One such early Christmas gift recipient is Amit Malhotra, whose Asian Handicrafts Pvt. Supplies décor items to global brands such as Walt Disney Co., Harrods of London, Target Corp. and Dillard’s Inc. Confirmed a 20% increase in orders over a year ago and increased production capacity.

“We shipped over 3.2 million units of Christmas decorations this year, up from 2.5 million last year,” said Malhotra, director of Asian Handicrafts. “Although China exports a significant share of Christmas decoration items, many first-time buyers have approached us now,” he said.

The trend is not limited to Christmas products. Exporters in Asia’s third largest economy have seen a significant increase in orders from both the United States and Europe, with the shift seen primarily in low-cost, labor-intensive sectors such as apparel, the crafts and non-electronic consumer goods. While the diversification of supply chains began with the US-China trade war in 2018, India had not seen significant gains at the time as countries like Vietnam cornered most of the orders that were moving away from Beijing. .

The pandemic, which has seen China adopt severe blockades, is helping to change that. India’s exports of goods, which hit $ 420 billion in the fiscal year ending March, have already reached nearly half that level in the five months since April. While it is not worth comparing to the $ 3.36 trillion annual Chinese exports, analysts see it as a good starting point for the subcontinent’s largest economy, which is currently growing at the fastest pace in the world.

“Taiwan, the EU, the United States, Japan are all willing to take a second look at India,” said Alex Capri, a researcher at the Hinrich Foundation, founded by US entrepreneur Merle Hinrich to promote sustainable global trade. .

Indian government data showed that Christmas decoration exports in the year ended March increased by more than 54% from fiscal 2020 levels, while handicraft exports saw a jump of about 32%. during the same period.

China’s continued decoupling from the global economy, coupled with the post-pandemic recovery, offers India the opportunity to accelerate its investment in long-term competitiveness and prioritize “winning” sectors, said Siddharth Jain, partner. in Kearney’s operations and performance practice. India is expected to have the most abundant workforce in the world by 2030 and could contribute more than $ 500 billion annually to the global economy, according to a report by Kearney and the World Economic Forum.

“We have begun to see the green shoots of this with India’s exports in FY22 reaching around $ 420 billion, much higher than in previous years,” Jain said. “This was brought about by a combination of external and internal factors.”

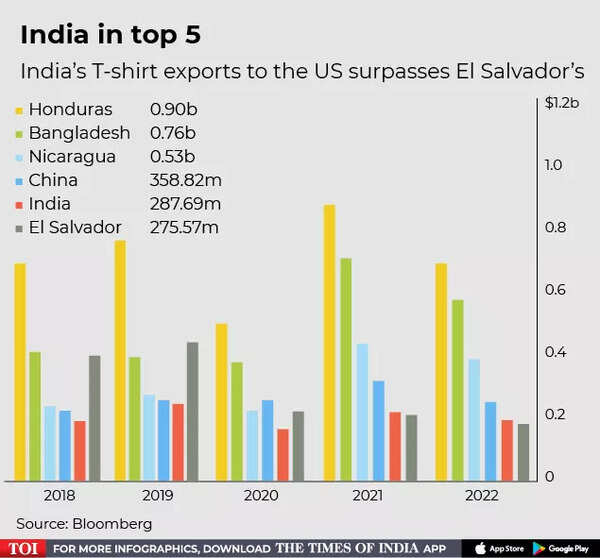

India also managed to overtake El Salvador by becoming one of the top 5 cotton t-shirt suppliers in the United States this year.

The clothing sector, in which India competes with nations such as Bangladesh, has seen an increase due to multiple factors, including the ban on all cotton products from China’s Xinjiang region for alleged mistreatment of its Uyghur Muslim ethnic minority, said Gautam Nair, chief executive officer at Matrix Clothing Pvt., a medium-sized clothing export company. “The surge was further accentuated due to the huge boom in buyer purchases and the diversification of the supply chain.”

Medium- and large-scale export companies experienced a 30% -40% jump in their order books last fiscal year and the recovery would be more visible in the current financial year ending March 2023, Nair said. Matrix Clothing, which exports apparel to global brands including Superdry, Ralph Lauren, Timberland and Napapijri, saw orders rise 45% last fiscal year compared to the pre-covid year.

However, there are obstacles to the growth of low-value-added manufacturing in the form of non-labor costs, analysts warn.

“The biggest problems are the problems of contract enforcement, tax transparency, etc.,” said Priyanka Kishore, an economist at Oxford Economics. “These represent a challenge to India’s manufacturing ambitions and must be addressed in order for the country to fully exploit its potential as a manufacturing hub.”