Indeed, remittances serve as a consistent source of inflows, distinct from repatriable NRI deposits. They play a role in reducing the current account deficit (CAD), which has progressively decreased as a proportion of India’s gross domestic product (GDP), states an ET report.

The United States has emerged as the largest contributor to remittances, constituting 23% of the total amount, according to a post-Covid survey conducted by the RBI. Meanwhile, remittances from the Gulf region have experienced a decline. Remittances are influenced by the extent of migration across various economies and the employment landscape.

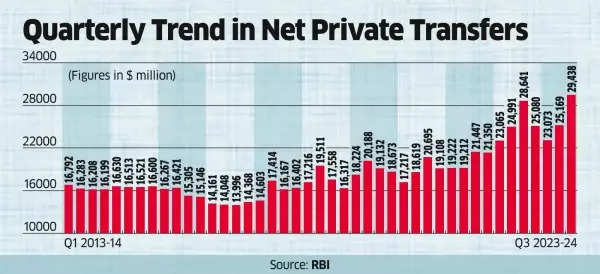

Quarterly Trend in Net Private Transfers

Madan Sabnavis, the chief economist at Bank of Baroda, attributed this trend to a prosperous year globally, especially in the US, where end-of-year bonuses are typically disbursed in December.

India has been a significant beneficiary of remittances, particularly since the 1990s software boom. In 2023, the country is estimated to have received over $100 billion in inflows, as per World Bank data. The majority of these remittances are allocated towards family support, with a portion also being invested in various assets, including deposits.

The influx of remittances, combined with a surge in services exports, has played a key role in reducing the current account deficit to 1.2% of GDP in the December quarter, down from 2% in the same period of 2022.

Also Read | Top SME IPOs based on returns: Why holding smaller stocks for a longer duration makes sense

Saugata Bhattacharya, an independent economist was quoted as highlighting the seasonal nature of remittance spikes in the third quarter, often linked to festive season obligations and currency fluctuations.

FCNR deposits have garnered significant interest, particularly when the rupee is weak, as banks bear the forex risk in such scenarios. The latest data shows that FCNR deposit inflows surpassed $4.15 billion during April-January 2023-24, more than three times the inflows from the previous year.

Also Read | Millionaire grandchildren! Not just Narayana Murthy’s grandson, these Infosys co-founders’ grandkids also hold stake in company

A research paper published in the July 2022 bulletin by RBI economists highlighted that India ranks as the second most affordable remittance-receiving market in the G20 group, following Mexico. However, the costs for specific remittance corridors have consistently exceeded others. The paper emphasized the necessity for policy interventions to broaden the scope of MTSS (Money Transfer Service Scheme) in high-cost corridors. MTSS allows prepaid cards to be issued by overseas authorized dealers to beneficiaries of remittances in India.