When this patient, while being discharged after three days of treatment, decided to pay the bill from his pocket rather than wait for insurance approval, he found that the bill went up by about 27%.The hospital insisted that it was standard practice for the bill to be more if a patient paid directly. Too tired and sick to argue, the patient was forced to pay the higher amount.

The 53-year-old patient, who was admitted in Fortis Hospital Gurgaon for suspected food poisoning with fever, severe dehydration and diarrhoea on April 14, was given a twin sharing room, for which he was charged Rs 8,400 per night, similar to the room tariff of a swanky hotel in Gurgaon for a single room, except that here, everything from nursing services, and linen and laundry to admission charges and bio-medical waste disposal was charged separate from the room rent.

“They delayed informing my insurance company, though all details including policy number and aadhaar card were given at the time of admission. That delayed the approval process. The doctor informed me on April 16 evening that I would be discharged the next day. I got a message from my insurance company at 8.07 pm on April 16 that they had received the claim. If I was admitted at 9.30 pm on April 14, why did it take them two days to inform the insurance company? We waited the whole day till 7.30 pm on April 17 for insurance approval. Finally, tired of waiting when I offered to pay, they jacked up the bill,” complained the patient. Till April 27 the insurance company had not processed his reimbursement claim.

TOI’s enquiries revealed that it was indeed standard practice for hospitals to have discounted rates for insurance companies and higher charges for patients who chose to pay themselves. However, this is not revealed to patients and there is no board put up outside hospitals giving the difference in rates charged to insurance companies and direct patients. In many hospitals, the difference is about 10%. “It is bad enough that there should be a difference in the rates for patients paying directly and for insurance companies. To charge a patient 27% more is plain loot. If anything, the patient paying directly ought to be charged less as the hospital is getting the money right away instead of having to wait for the approval process and so much back and forth with the insurance company asking for several clarifications on the bill. In fact, in many smaller hospitals they charge the patient less if they pay directly,” explained a doctor. Several other doctors that TOI spoke to echoed his words.

According to a TPA representative Anurag Goswami, insurance companies sign MoUs with hospitals to get negotiated rates. “To start with, they are seen as customers not patients. Our customers get the negotiated rates. If the customer goes directly, the amount will vary. We get the discounted rates because we bring them business/customers. These rates vary for different insurance companies. Sometimes, if a customer requests, they might get some discount. In the case of insurance through a bank, if there is any fraud you can complain to the RBI. In the case of an insurance company, you can complain to the IRDAI. If a private hospital does fraud, you cannot go anywhere because they have no governing authority. They know that. That is why they charge individual customers whatever they want,” said Goswami.

In response to TOI’s queries, Fortis Hospital, Gurgaon responded: “We initially offered hospital tariffs in accordance with our contractual obligations with Manipal Cigna insurance (Mediassist – TPA) for his hospital stay. However, due to multiple queries and delays in approval from the insurance side, the patient requested to settle the bill and seek reimbursement from the insurance company later. Consequently, as a normal industry-wide practice, standard hospital tariffs were applied, and the contractual discounts with Manipal Cigna were removed, resulting in an increase in the bill amount.”

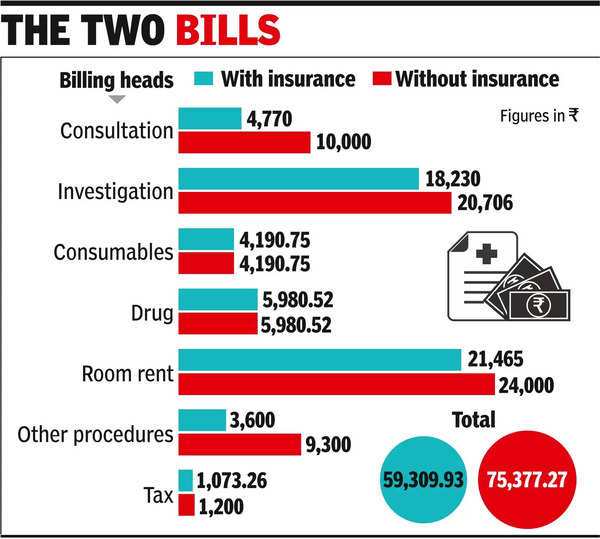

The two bills

| Billing heads | With insurance | Without insurance |

| Consultation | 4,770 | 10,000 |

| Investigation | 18,230 | 20,706 |

| Consumables | 4,190.75 | 4,190.75 |

| Drug | 5,980.52 | 5,980.52 |

| Room rent | 21,465 | 24,000 |

| Other procedures | 3,600 | 9,300 |

| Tax | 1,073.26 | 1,200 |

| Total | 59,309.93 | 75,377.27 |