The sensex opened the new trading week on a weak note and was down nearly 200 points from its Friday close.By mid-session it slid to an intra-day low at 71,866 points, then rallied to an intra-day high at 71,864 points and closed at 72,776, up 112 points.

On the NSE, the nifty closed 49 points up at 22,104.

As was seen in the past few weeks, foreign portfolio investors remained net sellers while domestic institutional investors were net buyers. At close of day’s trading, DIIs were net buyers at Rs 3,563 crore while FPIs recorded a net outflow of Rs 4,499 crore, BSE data showed. So far in May, foreign funds have net sold stocks worth nearly Rs 22,800 crore, data from CDSL and BSE showed. In contrast DIIs have net bought stocks worth nearly Rs 23,000 crore, BSE data showed.

Fund managers and institutional dealers said that with China and Hong Kong markets, for long an underperformer, showing some smart up move recently, some foreign fund managers are taking money out of India and putting the funds in those markets.

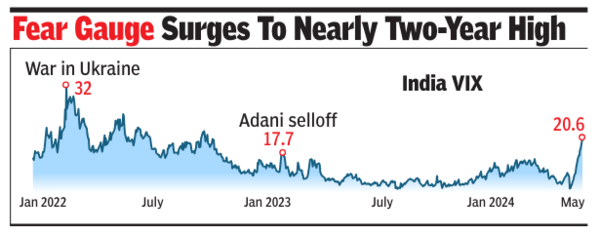

Volatility is another concern for domestic investors. The 998-point intra-day swing in the sensex was reflected in India VIX that scaled an intra-day high at 21.5, a level not seen since September 2022.

Brokers feel that a relatively low voter turnout in the current Lok Sabha polls is a cause for concern that could lead to some unpredictable outcome. When the first phase of polling started on April 19, most on Dalal Street were predicting a resounding victory for the ruling NDA. “Going ahead, markets would take cues from the voter’s turnout data from the fourth phase (of Lok Sabha polls), which has been a major concern so far,” said Siddhartha Khemka, Head – Retail Research, Motilal Oswal Financial Services.

In Monday’s session, the smart recovery in the sensex came on the back of strong buying in HDFC Bank, ICICI Bank and TCS while strong selling in stocks like Tata Motors, Bharti Airtel and SBI limited the index’s gain for the day.

Of the 30 sensex stocks, 16 closed higher while 14 closed in the red. In the broader market, laggards outnumbered winners with 2,254 stocks closing lower to 1,707 closing higher, BSE data showed.